Imported Inflation and Contracting External Demand: Double Risks China Needs to Be Wary of

February 22, 2022

About the author:

Zhang Chao, Fellow of Taihe Institute

Ou Yangrui, Fellow of Taihe Institute

Zhang Jiarui, Fellow of Taihe Institute

In 2022, the Fed’s higher-than-expected rate hike might trigger another round of financial turmoil, exposing China’s economy to the dual pressure of imported inflation and contracting external demand.

1. Fast-Growing Risk of US Financial Crisis

Financial crisis is not uncommon in the modern history of global financial development. Although each crisis has its own trigger, the root cause is basically the same: credit boom went bust. The financial crisis in 2008 and the COVID-19 outbreak since 2020 prompted the Fed to execute quantitative easing (QE) twice, and the two unprecedented rounds of monetary and fiscal expansion that followed quickly pumped up the asset price bubbles. Yet the Fed took an evasive action on the high inflation. As Treasury Secretary Janet Yellen and Fed Chairman Jerome Powell both acknowledged, the U.S. had already missed the best window of opportunity to put inflation under control. If a beleaguered Fed front-loads its higher-than-expected rate hike in 2022 - which is very likely to happen - the global financial market will go into a tailspin. And in the meantime, China’s economy will be facing dual pressure: imported inflation and contracting external demand.

1.1 USD Asset Price Bubbles and Inflation

The subprime mortgage crisis in 2008 and the COVID-19 pandemic in 2020 prompted the Fed to implement multiple rounds of “QE experiments,” which significantly pushed up the prices of financial assets in the U.S. as well as other countries, leading to obvious asset price bubbles. For example, as of the end of 2021, the S&P 500 index reached 4,500, three times as high as the level immediately before the subprime mortgage crisis. When it comes to the real estate bubble, which is arguably one of the main causes of the crisis, the Case-Shiller U.S. National Home Price Index is currently at 268 compared with 208 in 2008, and the price-to-rent ratio is 40% higher than the pre-crisis level.

It is worth noting that the above two rounds of QE had significantly different impacts on the US real economy. The first round was carried out in response to the subprime mortgage crisis. About 65% of the US money supply stayed within the financial system, which managed to promote financial asset price inflation but failed to significantly push up consumer prices. The second round, including a stimulus check for each eligible person, was carried out in response to the US government’s botched anti-epidemic efforts and the social and economic turmoil that followed. Unfortunately, such a policy caused little else than asset price inflation and consumer price inflation. In addition, the ongoing trade war has backfired on the US economy. In 2021, the US trade deficit rose to USD 859.1 billion, and the US CPI year-on-year growth reached 7.5% (the highest since 1982).

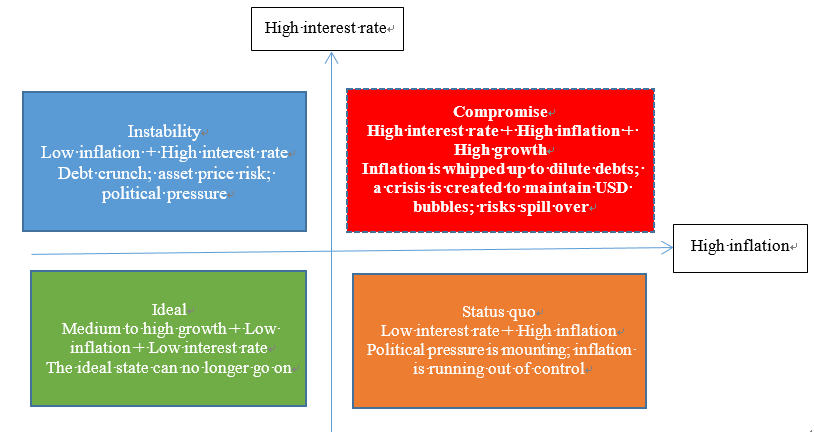

2022 will be another critical year for US politicians. President Biden’s approval rating has plummeted in less than a year. To win the mid-term election, Republicans and Democrats will inevitably butt heads over what to do about the inflation. Meanwhile, the market has come to believe that the Fed’s next rate hike is getting nearer and nearer. Since 2008, around 7 trillion dollars have been poured into the US market. A financial behemoth has already formed. Only by raising its interest rate more than expected does the Fed have a chance to tame inflation in the short term. However, such a rate hike will cause financial bubbles to burst, and therefore throw the market into turmoil. The next financial crisis is edging closer in 2022.

(Source: weixinso.com)

1.2 Six Reasons Why China’s Own Financial Environment Is Less Risky

As a comparison, China’s financial risks remain relatively low, as China has addressed some risk factors and pricked some price bubbles in advance, and maintained its own position in the current round of global monetary easing. At present, there are six major factors that weigh in favor of China’s financial market. First of all, the size of hot money in China has been small. Foreign capital in the A-share market takes up only 5%, and hot money in any other domestic financial asset market is also low. Secondly, China has imposed adequate control on foreign exchange and international capital flows. Cross-border capital flows have been well regulated, as China has built a solid “firewall” to prevent hot money from causing turmoil. Thirdly, China’s external debt ratio is low. China’s short-term external debt as percentage of GDP has fallen from 21% in 2013 to 7.4%. The decline in external debt has greatly reduced China’s risk exposure in the international capital market. Fourthly, China’s domestic asset price bubbles are not obvious. The total market cap of A-share companies is not significantly high (the current Shanghai Stock Exchange average PE has exceeded 47% of all its previous records, and the current Shenzhen Stock Exchange average PE has exceeded 52% of all its previous records). The real estate price bubble has been systematically and effectively addressed since 2017. China has already squeezed its financial asset price bubble in advance, and taken pain to prepare for potentially larger shocks. Fifthly, China’s monetary policy has been highly independent. Amid the recent wave of global monetary easing led by the Fed, China has managed to maintain the independence of its own monetary policy and refused to follow the trend. That leaves more room for monetary maneuvering. Sixthly, China has maintained trade surplus. China’s influence in global trade has further grown, bringing about steadily increasing trade surplus and stable foreign exchange reserves.

1.3 China’s Four Major Risk Factors

Although China’s overall financial risk is relatively low, we still need to check how well it can handle the impact of overseas financial turmoil. China currently faces four major risk factors. First of all, the balance sheets of Chinese companies are less healthy on the whole, featuring a high debt ratio and insufficient profitability. Moreover, their production efficiency has seen no significant progress, thus generating low profits. Unhealthy company balance sheets were often the major force turning financial crises into economic crises and even recessions. Therefore, improving Chinese companies’ balance sheets is a key immunity-boosting approach. Secondly, a large number of export-oriented Chinese SMEs have low profit margins and become vulnerable in the event of global financial shocks and declining overseas demand. Thirdly, China holds a large number of overseas assets displaying growing safety concerns and risks. Any international financial crisis may expose these assets to greater risks. Fourthly, China’s foreign trade has been overly reliant on US dollars. China’s import and export products are basically priced in US dollars, as well as many domestic commodities and assets. Therefore, the Fed’s monetary policy directly affects their value.

2. Imported Inflation and Contracting External Demand

2.1 Imported Inflation Originating from Staple Commodities

The Fed’s next rate hike will inevitably lead to a decline in the prices of interest-rate-sensitive financial assets, such as bonds and stocks. However, having survived several crises, global financial giants are now capable of handling such events, and their attempts to “milk” each and every crisis will inevitably prompt them to use new target assets as hedges against fall in traditional financial assets’ prices. During previous Fed rate hikes, staple commodities were often their preferred hedges. Since the 1990s, the Fed has carried out four rounds of interest rate hike (1994-1995, 1999-2000, 2004-2006, and 2015-2018), pushing up the prices of crude oil, copper, iron and other raw material commodities (average growth > 60%), where precious metal prices rose in three rounds (average growth: 25%) and food commodity prices rose in two rounds (average growth: 10%). Although China is the world’s largest manufacturer, it is still unable to independently provide sufficient raw materials for its industry value chains. Significant growth in the prices of raw materials, especially those used for production, will pose a huge threat to China’s economic and social stability.

On the other hand, the global commodity market is also changing, as heralded by new OPEC-like commodity cartels, such as Chilean Copper Nationalization Cartel and Chilean Lithium Trading Cartel, which bring more fluctuations to upper-stream prices. In the midstream, trading markets in Chicago, New York, London, Singapore have been shifting their focus from competition to cooperation, becoming the third party in the game of price (in addition to supply and demand).

2.2 Financial Crises Might Trigger “Cliff-Like Drop” in External Demand

It is very likely that US politicians will prompt the Fed to take an unexpected “hairpin turn” in monetary policy in 2022, and the US capital market has already seen huge price bubbles. As a result, the probability of an unprecedented financial crisis in major Western economies has been rapidly increasing, which might further reduce overseas demand. China’s foreign trade saw improvement in 2021 as COVID-19 slowed its competitors down, resulting in a high base effect. In the event of a sharp export fall in 2022, the amplification effect brought by China’s foreign trade performance will cause a greater negative confidence shock. Moreover, China will have 10 million new college graduates in 2022, while shrinking job offers and decline in confidence among SME employers (as a result of export decline) might bring extra risks to employment and social stability.

Since the 1990s, China has well-handled four rounds of the impact of foreign turmoil, including two demand shocks and two inflation shocks. In 2022, China is likely to face double shocks (lower demand + higher inflation) for the first time, which might be more complex and difficult to tackle.

(Source: news.sohu.com)

3. Multi-Pronged Approach to the Double Shocks

Considering the looming risks of imported inflation and contracting external demand, we put forward the following advice for addressing those risks. The incoming crisis might be a good opportunity to help promote internal strength and prepare for a new international order of financial market after the crisis.

The first measure is to integrate demand mix. Starting from the demand side of staple commodities, we need to integrate such demand, enhance upstream companies’ anti-risk capability, curb high-energy consuming, high-CO2 emission and low-end producers, and improve the efficiency in using upstream products.

The second measure is to apply policy combination for overall demand management, so as to support employment and maintain stability with the combined effort of monetary, fiscal, taxation and other policies as a “buffer” to resist financial shocks. In order to prepare for extreme shocks, it is necessary to formulate a plan for distributing financial subsidies and raising deficit rates, improve the efficiency of fiscal and monetary policies, apply appropriate methods for each specific region, narrow down gaps between urban and rural regions, promote rural revitalization, and set up special funds to bail out vulnerable industries to reduce side effects of the cyclical stimulus.

The third one is to facilitate the development of the digital yuan and RMB internationalization. Depending on China’s effective pandemic prevention and control, we could further promote the use of digital yuan as a substitute for cash in China. While promoting the stability of China’s financial infrastructure, we shall further promote the use of digital yuan in import and export trade, make good use of RMB credit strength as well as domestic manufacturers’ advantages in export, so as to enhance China’s influence on major trading partners, regional economic organizations, and currency swap systems.

When working with regional economic organizations such as RCEP, we should proactively research on how to create a long-term partnership. In the event of volatile exchange rate fluctuations caused by the double shocks, China shall facilitate the building of a multi-polar international monetary system on the basis of the Belt and Road initiative and regional economic relations, so as to mitigate some risks arising from external shocks in the long term.

——————————————

ON TIMES WE FOCUS.

Should you have any questions, please contact us at public@taiheglobal.org