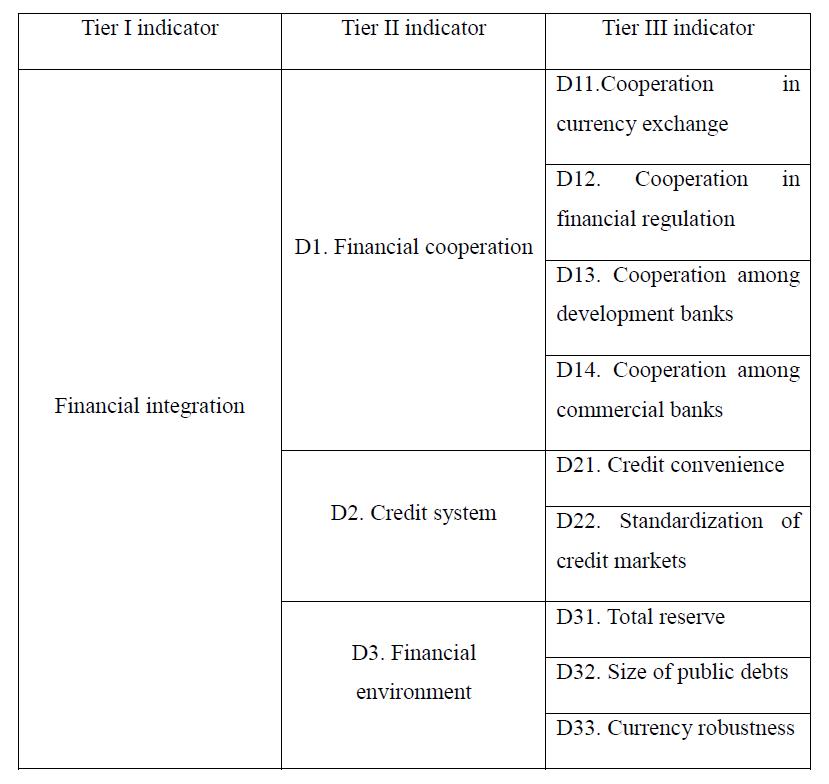

As the number of Belt and Road Initiative countries and regions has increased over the past five years, so has the scope and depth of financial integration. In response to the above changes, especially the progress in the areas of commercial bank cooperation and development bank cooperation, we have optimized the index system of financial integration and improved the methods of measurement and classification. This year's index system is as follows:

Unlike the four-level classification method adopted by the report of last year, the research group divides the level of trade between China and 94 Belt and Road Initiative partners into five grades: smooth (> 14), connected (12-14), good (10-12), potential (8-10) and weak (< 8). Based on the new indicators and classification system, we analyze the current situation of financial integration between China and 94 countries as follows:

There is still much room for improvement in financial integration within the Belt and Road Initiative, and the overall level of each country varies considerably. There are some countries with a relatively low financial integration level, so there is potential for further construction. In 2017, the 94 Belt and Road Initiative partners had an average of 9.88 in financial integration, which is at the level of "potential". Among these 94 countries, 18 are at smooth level, 10 are at connected level, 17 are at good level, 9 are at potential and 40 are at weak level. This means that more than half (52 percent) of the countries are at a low level in financial integration (level of potential and weak), while less than 30 percent (29.7 percent) are at a high level (level of smooth and connected). This shows that there is still considerable room for the construction of financial integration. Financial cooperation between China and the Belt and Road Initiative countries still needs to be further strengthened in both breadth and depth.

Within the Belt and Road Initiative, the level of financial integration is far less differentiated between regions than within different nations of the regions. This shows that China is building a sound backbone of financing in each region, and it also indicates the possibility of relying on these backbone countries to raise the overall level of financial integration in the region in the next step. In terms of scores in financial integration, the regions along the B&R rank as follows (from high to low): Southeast Asia (12.50), Central Asia and Mongolia (11.64), Europe (10.73), Eurasia (10.55), South Asia (9.26), Oceania (8.74), West Asia and North Africa (8.61), Central and Eastern Europe (8.18). Southeast Asia, as a whole, is at the connected level; Central Asia, Europe and Eurasia are at good level; South Asia, Oceania, West Asia, North Africa and Central and Eastern Europe are at potential level.

Most countries are at the level of "weak" in terms of financial integration, but the overall level of all the regions is above the level of "weak". This means that there are some countries in each region that have a high level of financial integration which can increase the average score of the region. In Central and Eastern Europe, for example, Hungary (15.47), Poland (11.68), Lithuania (10.61) and the Czech Republic (10.08) are at a high level, while the other 12 Central and Eastern European countries, excluding these four, have an average of 6.93. Another example is the 18 countries in West Asia and North Africa. The nine countries at the lower end of the 18 countries have an average of only 4.88, but the United Arab Emirates, Turkey, Qatar and Morocco, which are at the higher end, are at the level of "smooth" or "connected". This phenomenon of small regional differences but large intra-regional differences reflects the success of the Belt and Road Initiative over the past five years. There are strong backbone countries in each major region, such as Hungary in Central and Eastern Europe; United Arab Emirates in West Asia and North Africa; Switzerland, Germany and Ireland in Europe; Australia, and New Zealand in Oceania; Russian, Belarus and Ukraine in Eurasia; India and Pakistan in South Asia. Such a phenomenon also reflects the tremendous potential of the Belt and Road Initiative in the future, that is, the possibility of raising the level of financial integration for other countries in the region from these countries with high scores in financial integration.

Compared with the other four Connectivity, the realization of financial integration is more dependent on the realization of the other Connectivity (see Table 1). Therefore, in order to promote financial integration, in addition to finding ways directly related to finance itself (such as strengthening bilateral financial cooperation, supporting the improvement of domestic credit systems of the host nations, improving domestic financial environment, etc.) we shall never ignore the effect of improvement in people-to-people bond and impeded trade on financial integration.

From the radar map of the Tier II indicators and Tier III indicators (the dimension difference of Tier III indicators is too big to be directly put into the radar map for comparison, so the comparison is made after maximum and minimum standardization) we can note that differences exist in specific areas. In Tier II indicators, D1 (financial cooperation) is higher than D3 (financial environment) and D2 (credit system). Tier III indicators can be roughly divided into two grades. The first grade is higher than 0.49. They are D12 (cooperation of financial supervision), D21 (credit convenience), D22 (credit market standardization) and D33 (currency stability). The second grade is D11 (currency swap cooperation), D13 (development bank cooperation), D14 (commercial bank cooperation), D31 (total reserves) and D32 (public debt scale). Therefore, in order to further improve the financial integration index between China and countries along the B&R, while maintaining the development of areas of advantage, we should also selectively continue to strengthen our efforts on the areas with low scores, such as all items but financial supervision cooperation in D1. However, we should be cautious with involvement in some areas, such as the aggregate reserves and public debt of the target country, because such areas closely related to the economic base and the structure of its existing national economy, and the involvement of external forces may have a very limited impact them.

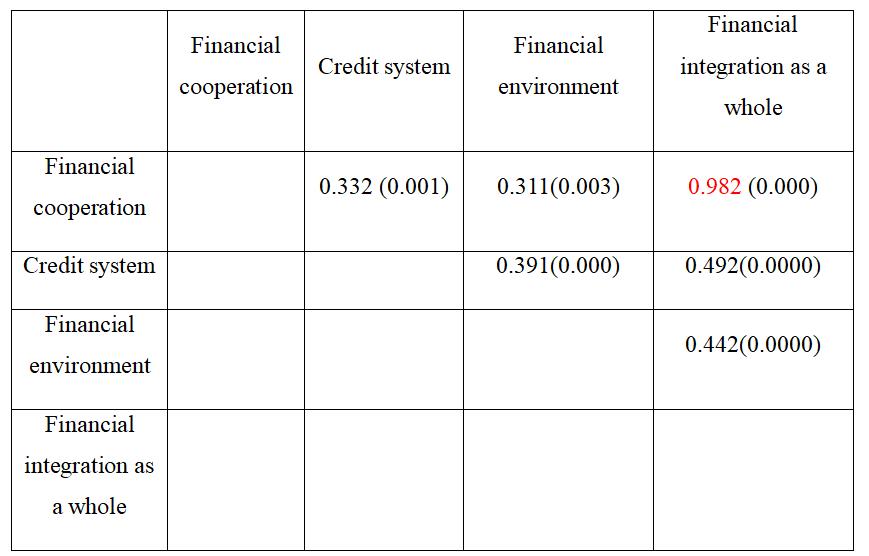

From the analysis of the correlation coefficients between Tier II indicators and financial integration, the relationship between the three Tier II indicators (financial cooperation, credit system, financial environment) and the overall financial integration is uneven (Table 2). The closest relationship is the relationship between financial cooperation and financial integration, followed by the relationship between the credit system and financial integration, and between financial environment and the financial integration. The relationships between the three Tier II indicators are the lowest. Therefore, in order to promote the overall level of financial integration, we can continue to have financial cooperation with countries along the Belt and Road, which will achieve immediate results. The financial cooperation here mainly includes four aspects: currency swap, financial supervision, development bank and commercial bank cooperation. In the area of development bank cooperation, benefiting from the high transparency of the AIIB and ADB project library, we measure the level of development bank cooperation based on project data. At the same time, the degree of financial openness of the target country has been taken into account in the level of commercial bank cooperation, because there is still a long way to go between the landing of Chinese commercial banks and the starting of local business, and the relatively convenient and reasonable way to measure this distance is to take into account the extent of financial openness of the country, that is, the scope of financial services provided by foreign banks in the country.

As can be seen from the high correlation between financial cooperation and financial integration in Table 2, all Tier II indicators under financial cooperation have an obvious promoting effect on the improvement of the level of financial integration. That is, measures such as updating and expanding China's currency swap agreements with other countries, cooperating with more countries in financial supervision, supporting countries in joining the ADB and obtaining projects from it, continuing to expand bank branches in countries along the B&R, and promoting financial openness in host countries, will all directly help to raise the overall level of financial integration.

It is worth noting that the correlation between the four Tier III indicators and financial integration is also higher than that between credit system and financial environment and financial integration: the correlation between commercial bank cooperation and financial cooperation is the highest (0.835), followed by financial supervision (0.67), development bank cooperation (0.533) and currency swap (0.505). However, from the perspective of availability, there is limited room to continue to strengthen financial supervision cooperation, and there is not much room for the expansion of Asian Development Bank and Asian Infrastructure Investment Bank. Therefore, in the current international environment, updating and expanding the currency swap agreements between China and other countries and expanding the investment projects of development banks are more feasible ways to promote financial integration.

On currency swap cooperation, since the amount of currency swap agreements can increase by nature and with the further development of economic and trade and financial relations between China and relevant countries, the need to avoid exchange rate fluctuations will become stronger (this includes not only the bilateral exchange rate, but also the exchange rate with third parties). There will be substantial demand for the renewal of currency swap agreements and the increase in the amount of currency swap agreements. This is also why the report considers it relatively easy to continue to strengthen the building of currency swap agreements.

This also applies to development bank cooperation. The number of projects can be increased, and projects under investigation and projects under construction may in the future become ongoing projects and completed projects, so we can draw the conclusion that the number of projects in the future will continue to increase. This positive cycle, which contributes to improvement of the level of financial integration, is worthy of further development. Moreover, the infrastructure and livelihood facilities projects supported by the Development Bank have a certain positive cycle, that is, with the implementation and role of the above-mentioned projects, local economy and society will have further development, thereby generating new project demand. Therefore, the potential for further development of development bank cooperation is highly expected.

Although the correlation coefficient of commercial bank cooperation is the highest, the complexity is also great. On the one hand, after the signing of the landing agreement and the completion of the landing of the branch office, the business expenditure of our commercial bank in the host country is restricted by the overall financial opening and financial development level of that country and the depth of continued exploration is not under our control. On the other hand, although promotion of the level of financial openness in the host country is an area which we can strengthen through cooperation with the IMF and the Western countries and, if handled properly, will bring win-win results for China, the Western countries and the target countries, and alleviate the worries of other countries, the level of financial openness is an important component of a country's financial sovereignty; and given the limited level of financial openness in China, it is quite inconvenient for China to promote the financial openness of the target countries.

The credit system reflects the convenience of obtaining credit in a country and the degree of normalization of its domestic credit market, which is a sign of the development level of a country's domestic financial system. Its relatively high correlation with financial integration indicates that supporting the construction of service level and predictability of domestic financial markets for various types of economic entities in the country also has a positive effect on the construction of the financial integration of the Belt and Road Initiative. It should be noted though that each country has its own financial sovereignty, and the development of each country's financial credit market has its own history and established pattern of interests. China should not be too aggressive in this area. Rather, China can take decisive actions when there are conditions favorable to the convenience and normalization of the financial system both domestically and internationally.

The financial environment reflects the health of the macro-economy of each country, especially the stability of the financial sector. This means that helping Belt and Road countries achieve their domestic financial stability, in particular by overcoming debt and international payment difficulties, is important to facilitating financial integration of the Belt and Road. Of course, a country's domestic financial stability is largely determined by its own economic policies. Moreover, if a country pinned its domestic finance entirely on foreign support, it would easily induce moral hazard, making financial stability even more difficult to achieve. Therefore, tailored financing for a country in support of its financial stability needs to be accompanied by some assurances of domestic reform.

Based on the above analysis, the report argues that China's financial cooperation with the Belt and Road countries needs to be further strengthened in both breadth and depth. The level of differentiation within the region is higher than the level of differentiation between regions, which creates conditions for China to rely on backbone countries of the region to expand the level of financial integration in the whole region. In terms of specific measures, expanding China's currency swap agreements with other countries and expanding the investment projects of the development bank, are two choices with low risk and good expected outcomes.

—————————————————————

FOCUS ON CONTEMPORARY NEEDS.

Should you have any questions, please contact us at public@taiheglobal.org