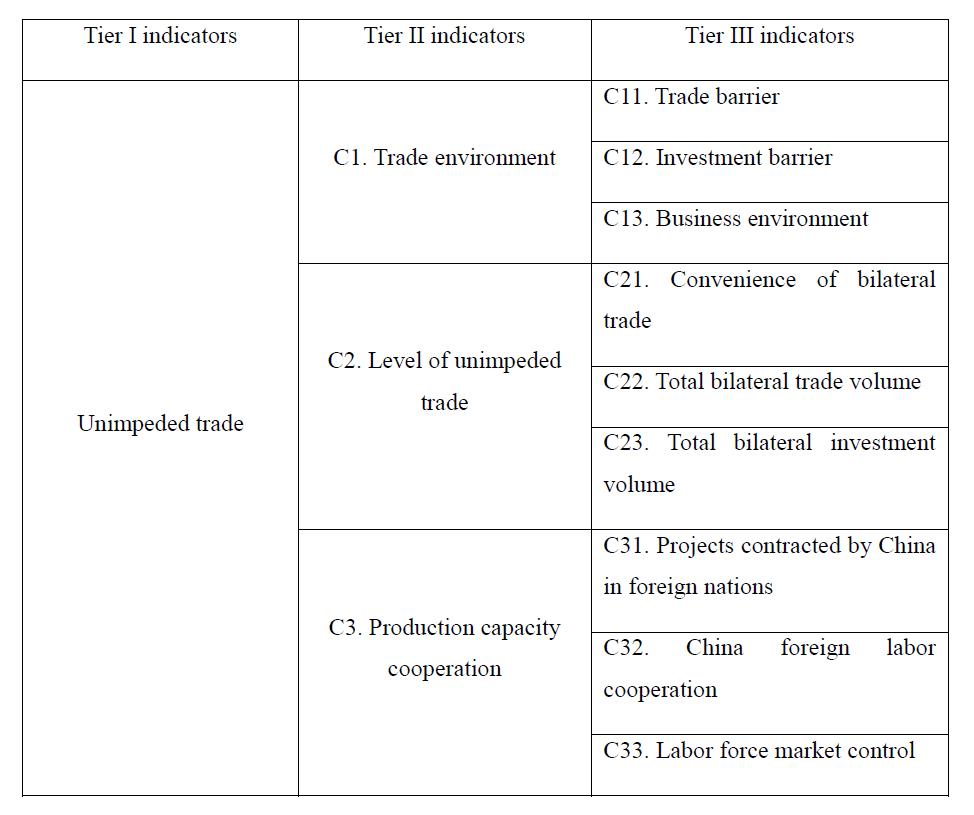

The Belt and Road Initiative is aimed at building new trade routes. The importance of unimpeded trade to the Belt and Road Initiative is self-evident. Thanks to the importance attached by all parties to unimpeded trade, great progress has been made in the depth and breadth of Sino-foreign cooperation in this field. In order to reflect this change, the research group has improved the calculation method this year. The new index system is as follows:

This year, the research group has restructured the classification criteria and divided the level of trade between China and 94 Belt and Road Initiative partners into five grades: smooth (> 14), connected (12-14), good (10-12), potential (8-10) and weak (< 8). Under this new classification system, we are analyzing the current situation and prospects of trade between China and 94 countries as follows:

The Belt and Road Initiative has made tremendous achievements in smooth trade, which can be seen from the fact that there is little difference between different regions and that different regions all maintain a high level of trade. Future development requires not only consolidating the current high level of trade between regions and countries in the context of the current global political and economic context, but also selectively relying on countries with high levels of trade to further tap the trade potential of a number of countries with low levels of trade.

Specifically, in 2017, 94 Belt and Road Initiative partners had an average trade flow score of 12.36, which can be classified as "good". Of these 94 countries, 25 were smooth (7 of them scored more than 16 points, or super-smooth. They were Singapore, Malaysia, Germany, Australia, Netherlands, New Zealand, and Saudi Arabia): 28 were connected, 27 were good, 9 were potential (Samoa, Brunei, Vanuatu, Czech Republic, Afghanistan, Maldives, Portugal, Slovakia, Macedonia), and 5 were weak (Moldova, Tonga, Syria, Palestine, Cook Islands).

At the regional level, the averages of index of countries in different regions are ranked from high to low as follows: Southeast Asia (14.12), Europe (13.31), Central Asia and Mongolia (12.39), West Asia and North Africa (12.24), South Asia (11.19), Eurasia (11.45, all former Soviet Union countries but Estonia, Latvia, Lithuania), Central and Eastern Europe (11.24), and Oceania (11.21). Southeast Asia belongs to the smooth type; Europe, West Asia and North Africa, Central Asia and Mongolia belong to the connected type, South Asia, Eurasia, Central and Eastern Europe, Oceania belong to the good type. It is noteworthy, however, that the differentiation of the intra-regional trade index varies somewhat. In terms of standard deviations of index of the countries, the regions rank as follows: Oceania (4.048), South-East Asia (3.031), West Asia and North Africa (2.539), Eurasia (2.462), Central Asia and Mongolia (2.169), Europe (2.029), South Asia (2.005) and Central and Eastern Europe (1.595). This indicates that there are intra-regional differences in trade indicators in Oceania, South-East Asia, West Asia and North Africa and Eurasia. In Oceania, there are both countries with high trade scores, such as Australia and New Zealand in the north part, and countries with very low trade flow scores, such as Tonga and the Cook Islands; in Southeast Asia, there are both high-score countries such as Singapore, Malaysia and Vietnam, as well as low trade score countries such as Brunei, Timor-Leste; in West Asia and North Africa , there are both high-score countries such as Saudi Arabia, Cartel, Israel, and low trade score countries such as Lebanon, Syria, Palestine; and in Eurasia, there are both high score countries such as Russia, Georgia and low trade score countries such as Moldova.

It is evident that some of the countries with lower scores in impeded trade have insurmountable disadvantages, such as internal political and security instability (such countries include Syria, Palestine, etc.). Others have limited resources, such as Tonga, the Cook Islands, etc. The development of the index in impeded trade for these two kinds of countries is relatively difficult. Moreover, there are also countries that can rely on neighboring large countries with high trade indices, such as Moldova which is located between Romania and Ukraine (the quality of red wine and other agricultural products of Moldova is high, and the FTA between China and Moldova is under negotiation with future development expected) and Brunei which is within the Malaysia rim (Brunei has rich oil and gas resources, and development with it is worth strengthening).

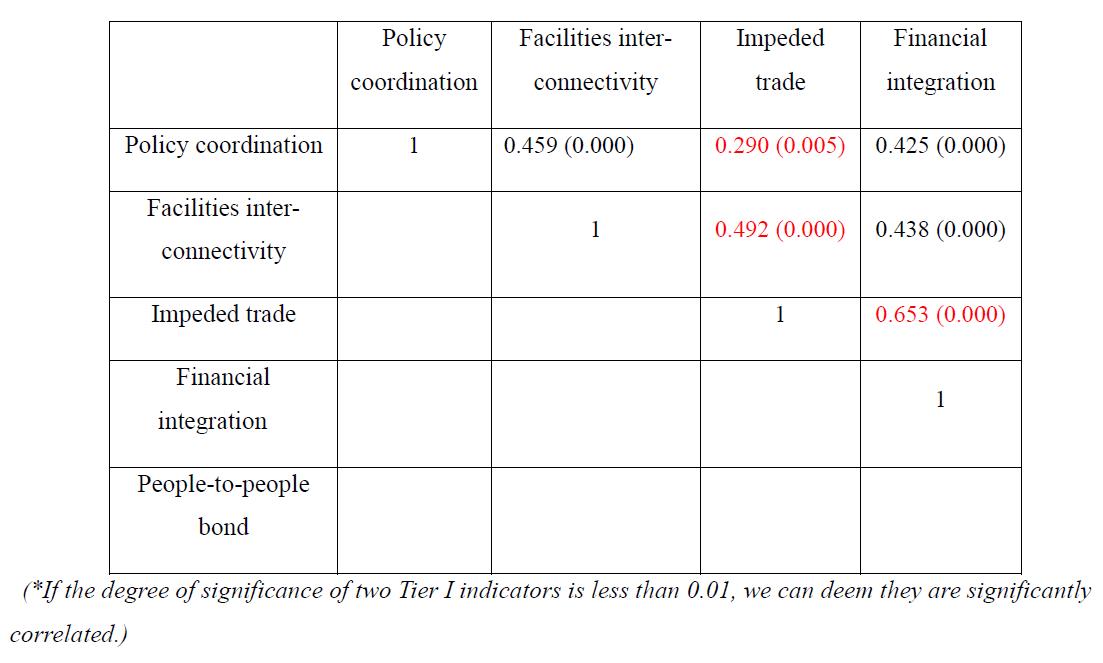

In terms of relationship between the Five Connectivity, impeded trade is most closely related to financial integration, then to people-to-people bond, facilities connectivity, and least to policy coordination. Therefore, in order to promote impeded trade, in addition to finding ways directly related to trade itself (such as improving domestic trade environment, improving the smoothness of bilateral trade, strengthening bilateral production capacity cooperation, etc.) we shall never ignore the effect of improvement in financial integration and people-to-people bond.

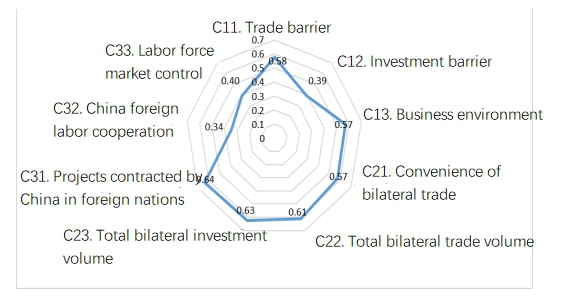

From the radar charts of Tier II indicators and Tier III indicators, we can see that the level of trade between China and the Belt and Road Initiative countries is relatively high, but there are still some differences in specific areas. As far as Tier II indicators are concerned, C2 (level of impeded trade) is better than C3 (production capacity cooperation) and C1 (trade environment). Tier III indicators can generally be classified into two categories: those scoring around 0.6, including all Tier III indicators under C2 and C31 (projects contracted by China in foreign nations), C11(trade barrier), and C13 (business environment); and those scoring under 0.4, including C12 (investment barrier), C32 (foreign labor cooperation), and C33 (local labor market). From this we can see, to further enhance impeded trade index between China and countries along the B&R, we should strengthen efforts in areas of low scores while maintaining the areas of advantage. Special efforts should be made to areas such as C12 (investment barrier) and C33 (local labor market), which have a great supporting effect on other areas. Currently, in the international context, efforts made from multiple angles to further strengthen China's economic ties with the Belt and Road Initiative countries will have a great positive effect on future economic competition with other international economic powers.

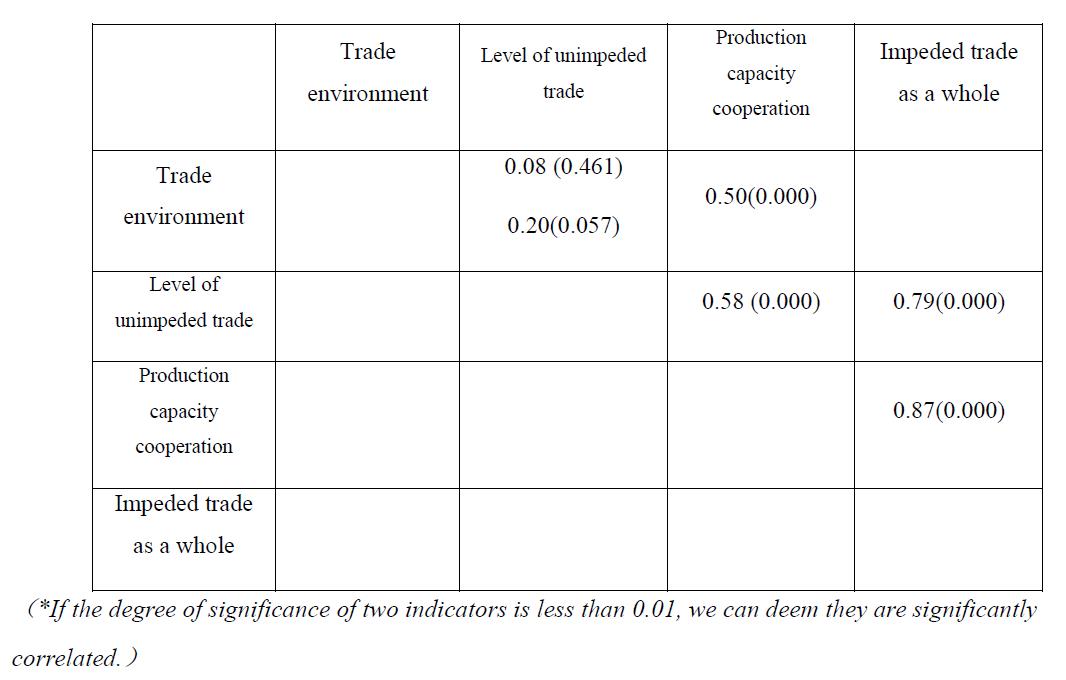

From the analysis of correlation coefficients between different components of impeded trade and the effect thereupon of different components, we can see that production capacity cooperation has the greatest influence on unimpeded trade, followed by the degree of smoothness and trade environment. The degree of smoothness and production capacity cooperation has a great impact on each other. Also, the relationships between trade environment and smoothness, and trade environment and production capacity cooperation, are not very close. The relative separation between trade environment and other components is due to objective reasons. Our measurements of trade environment include trade barriers, investment barriers, and the business environment, but these indicators describe those factors within the target country to all countries. The separation between trade environment and impeded trade and other components can be interpreted as a peculiarity of the Belt and Road Initiative.

The overall impact of production capacity cooperation on impeded trade is also worthy of analysis. Production capacity cooperation in this report consists mainly of three parts: projects contracted by China in foreign nations; China's foreign labor cooperation and labor market control, or, in other words, China's ability to export labor services to the host nation.

The significant correlation between production capacity cooperation and impeded trade has both positive and negative interpretations. On the one hand, it highlights the leading role of production capacity cooperation in promoting the smooth flow of trade, and highlights that the Belt and Road Initiative has greatly facilitated the realization of "going global" and the strengthening of economic ties between China and foreign countries. This is an important manifestation of the new international economic and trade ties with Chinese characteristics. On the other hand, the export of labor services to host nations also means that the integration of the local labor market into the Belt and Road Initiative is not strong enough, and the labor force, which is one of the important factors of production, is heavily dependent on China's domestic labor.

A two-pronged approach may be the way to further enhance the links between production capacity cooperation and impeded trade. First, we should vigorously support labor cooperation and foreign contracting projects in order to continue their role in promoting trade as a whole. Second, it is time to vigorously promote the integration of the local labor market with our Belt and Road Initiative. Mobilizing the local labor force to take part in China-led construction more conveniently will bring more benefits to local governments, which will continue to increase the political legitimacy of the Belt and Road Initiative, and make wider use of local labor resources. This, in turn, enhances the economic legitimacy of the Belt and Road Initiative.

The close positive correlation between the degree of smoothness and the overall level of unimpeded trade fully reflects the achievements of the Belt and Road Initiative. The smoothness of trade in this report consists mainly of three parts: total bilateral trade volume in goods, total investment volume and weighted average of tariffs. These three items are the actual content of unimpeded trade, which can be reflected by their close positive correlation with it. However, it is noteworthy that these three items differ in their relevance to impeded trade. Weighted average tariffs, compared with total bilateral trade volume in goods and total investment, less closely related to degree of smoothness and impeded trade. Therefore, the present report argues that if we want to continue to improve the overall impeded trade by way of improvement in the degree of smoothness, we still need to continue to strengthen the trade and investment volume: that is, making progress to improve the level of bilateral trade and investment.

Of course, other complexities of trade still need to be further considered. In addition to tariffs, various non-tariff trade barriers have a greater impact on trade, which deserves more attention and caution. Their current impact on trade flows deserves further study. Trade, investment, tariff, non-tariff barriers and their relationship are the main contents of the existing international political economy theory. If we apply this theory to practice, we must consider the following factors. First, some studies suggest that democracies prefer to use non-tariff barriers that are more complex and less intuitive than tariffs to differentiate between foreign competitors, in order to protect domestic industrial interests without arousing the attention of the general domestic population (consumers of foreign products). Most of the countries along the B&R are democracies or at least semi-democracies (such as partly free nations assessed by the Freedom House) which are more likely to circumvent tariffs and control our trade with them through non-tariff barriers. Hence, there is a need for greater vigilance in this area in the future. Second, there are also studies suggesting that there may be competing relationships between trade and investment. In other words, a major motivation for one country to invest in another country is to circumvent tariff or non-tariff trade barriers. This mutual tension between trade and investment makes the overall rapid growth of impeded trade index difficult to sustain. However, for China's Belt and Road Initiative, it is possible to boost bilateral trade and investment due to the advantages of relying on China, an economic entity with both a huge market and a huge production capacity. When the growth of China's consumer market and the power of the BRI to drive the growth of the consumer market of the relevant countries are brought into play, it is still possible to realize the positive cycle of the growth of bilateral trade and China's outward investment.

Impeded trade is a significant component of the Belt and Road Initiative, with high average levels and high levels in all regions. Countries that are currently at a limited level can selectively strengthen their bilateral trade relations with China in the future. The improvement in financial integration and people-to-people bond can enhance impeded trade greatly. Within impeded trade, the role of production capacity cooperation as a catalyst deserves attention, and the integration of local labor markets needs to be taken into account in the future. The impact of continued improvement of bilateral trade and investment level on overall trade smoothness still needs further attention. Finally, in the future, we need to pay attention to the non-tariff barriers to trade and the complexity of the competitive relationship between trade and investment.

—————————————————————

FOCUS ON CONTEMPORARY NEEDS.

Should you have any questions, please contact us at public@taiheglobal.org