Facilities connectivity is a basic area of priority for the Belt and Road Initiative construction and a link between the "Five Connectivity", providing strong basic support for policy coordination, unimpeded trade, financing integration and people-to-people bond. With the rapid development of connectivity between China and other countries along the Belt and Road, infrastructure cooperation has transitioned from concept to action and from vision to reality. Under the Belt and Road Initiative, the Chinese Government and countries along the Belt and Road have followed the principles of consultation, contribution and shared benefits, and vigorously promoted infrastructure construction and the construction of international backbone corridors such as transport, power, telecommunications in countries along the Belt and Road. This has played an important role in supporting the economic development of countries along the Belt and Road and the improvement of people's living standards.

In 2017, Chinese enterprises invested USD 5.12 billion in infrastructure construction in countries along the Belt and Road. By the end of 2017, the stock of infrastructure investments in countries along the Belt and Road amounted to USD 34.55 billion, accounting for 27.6 percent and 23.7 percent of the investments in countries along the Belt and Road respectively.

In addition, since 2014, the Silk Road Fund, the China-Eurasia Economic Cooperation Fund and the China-Central and Eastern Europe Fund have been established successively, and together with the China-ASEAN Fund (established in 2009) and the China-ASEAN Maritime Cooperation Fund (established in 2011), the total amount of the development funds has exceeded US $50 billion. Compared with the average loan rate of the countries along the B&R which exceeds 13 percent (World Bank data), the investment and financing capacity of Chinese enterprises has become an important advantage in participating in the infrastructure construction of the countries along the B&R.

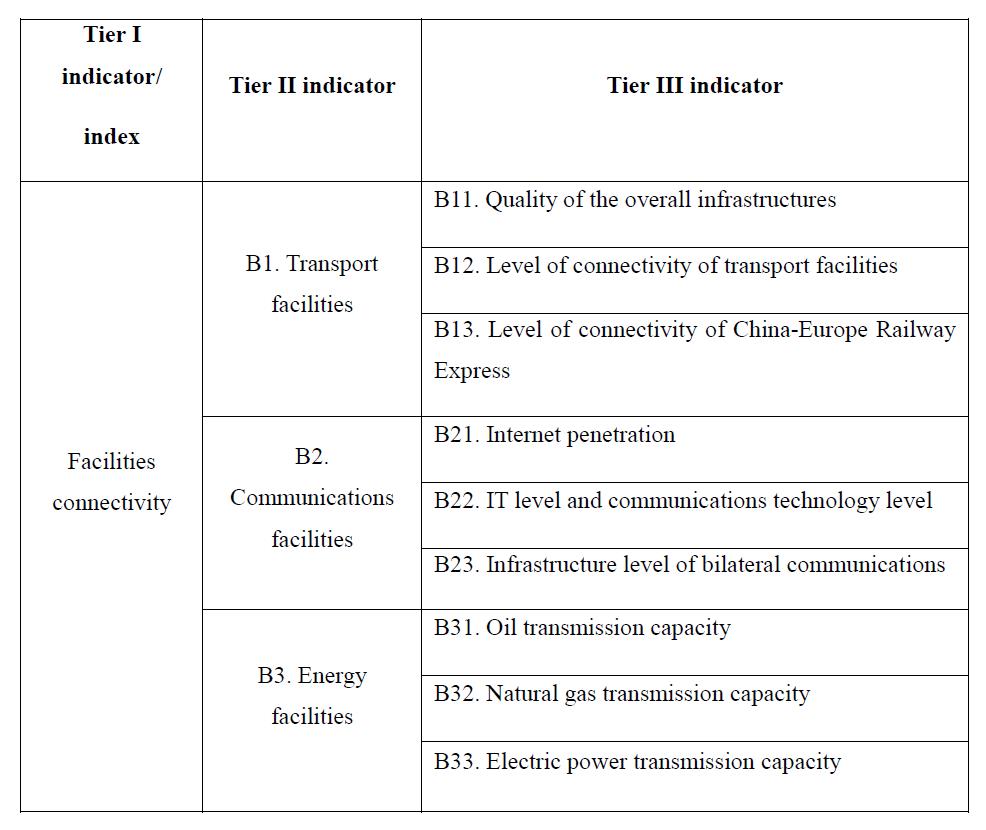

According to the latest index evaluation system of the BRI "Five Connectivity Index" Research Group of Peking University in 2018, three infrastructure indicators, transport, communications and energy, are selected as the main reference to evaluate the facilities connectivity. The indicator system includes three Tier II indicators and nine Tier III indicators. As shown in Table 1, transport facilities indicator is composed of overall infrastructure quality, transportation facility connectivity indicator and whether the nation has CHINA RAILWAY Express. It not only reflects the level of infrastructure development in the countries along the B&R and the degree of bilateral infrastructure connectivity, but also shows the recent infrastructure development in China and Europe, which has become a key element in supporting land trade between China and the countries along the B&R.

Communications infrastructure indicator consists of Internet penetration, bilateral infrastructure development level and information services export indicators, which reflects the content of infrastructure development level and infrastructure services efficiency. Energy infrastructure indicator includes oil, gas and electricity transmission capacity, which reflect the level of development of these three key energy resources interconnected through energy infrastructure.

In addition, in contrast to the four-level classification applied last year, the research group has classified the connectivity degree of 94 Belt and Road facilities in China into five levels: smooth (>14), connected (12-14), good (10-12), potential (8-10) and weak (<8). Based on the new indicators and classification system, the research group has analyzed the overall situation of facilities connectivity between China and 94 countries this year as follows:

In 2017, Facilities Connectivity of the Belt and Road developed steadily, and overall the scores are higher than those of last year. However, there is still much room for improvement. Specifically, first, the average facilities connectivity score of the nine Belt and Road countries in 2017 was 9.71, ranking last among the countries related to Five Connectivity, and they can only be classified as potential partners in the hierarchy. In the five major areas, the differentiated development trend in the Belt and Road Initiative is becoming clearer.

Second, only four of these 94 countries are smooth cooperation countries (among them, only Russia, who tops the list, scores more than 16, which can be called a super-smooth country, while Iran, Germany and Myanmar all score just over 14, which is the bottom line for smooth cooperation nations).

Third, there are 15 countries with a total score of more than 12 this year, which is much different from last year when there were 14 such countries. However, it is worth noting that the number of weak countries has fallen from 10 in 2016 to 5 this year, which is an encouraging sign of progress.

Fourth, with the exception of Russia, which remains stably super-smooth with high scores, the list of smooth and connected countries has shifted considerably. Among them, Iran, Germany and Myanmar have made rapid progress in facilities connectivity, and all of them have become smooth countries. Saudi Arabia, Turkey, the Czech Republic and Mongolia remained stable, while the scores of United Arab Emirates, Malaysia, Qatar and Singapore fell significantly from those of last year.

Fifth and finally, in terms of facilities connectivity, the connectivity of countries along the Silk Road Economic Belt has generally developed better than Maritime Silk Road connectivity. This is reflected in the fact that 4 smooth countries and 11 connected countries are all land-connected, while 5 weak countries are maritime-connected.

Compared with other four Connectivity indices, facilities connectivity is the link of Five Connectivity. It is significantly related to other four Connectivity indices, and provides strong basic support for policy coordination, unimpeded trade, financial integration and people-to-people bond. Therefore, facilities connectivity should be the priority area of China's Belt and Road Initiative, so that facilities connectivity can become a leading driving force for the development of other connectivity.

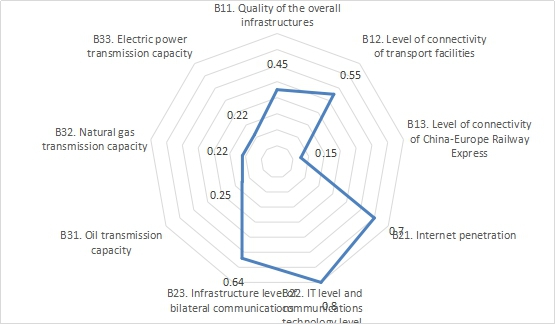

According to the radar chart of the Tier II and Tier III indicators which measures facilities connectivity, there are obvious polarization differences among the indicators within the facilities connectivity. In terms of Tier II indicators, B2 (communication facilities) developed best, far higher than B1 (transport facilities) and B3 (energy facilities). Although the development of B3 (energy facilities) is relatively better than that B1 (transport facilities), the development of both B3 and B1 is lagging. Regarding this, China should attach greater importance to the development of backward areas in future planning; alternatively, it should also be recognized that there are objective reasons for the relatively slow development of a large amount of transport and energy facilities, such as a long engineering cycle, difficult engineering and various political and security factors.

The development of the three Tier II indicators can be seen in the following aspects. First, railway construction and logistics network jointly promote the development of land transport. The construction of transport infrastructure such as the CHINA RAILWAY Express, China-Europe Land-Sea Express Route and logistics outlets along the B&R continue to advance, speeding up China's connectivity with Central Asia and Central and Eastern Europe, promoting communication and exchanges between the countries along the B&R and western China, and strongly supporting the development of land-based trade. The Mombasa-Nairobi Railway in Kenya has been completed and opened to traffic. The China-Laos Railway, Pakistan Karakorum Highway Phase II, China-Maldives Friendship Bridge project in Maldives and other major projects have been accelerated. The Tehran-Mashhad High-speed Railway in Iran and Han Bantota Port in Sri Lanka have been steadily implemented. In 2017, of China's exports to Belt and Road countries, those by railway grew the fastest with an increase of 34.5 percent compared with those of 2016. As of August 2018, the cumulative quantity of CHINA RAILWAY Express had exceeded 10,000, and nearly 800,000 TEUs of goods had arrived in 43 cities in 15 European countries with a return rate of 85 percent.

Second, port cooperation and wharf construction promote the sustainable development of maritime transport. In recent years, Chinese enterprises have paid great attention to the ports of countries along the Maritime Silk Road. Investments in terminals have further increased, with the construction of nearly 20 ports, including Colombo Port, the largest seaport in Sri Lanka, Kumbo Port, the third largest container terminal in Turkey, Valencia Port in Spain, the port of largest container throughput in Mediterranean, Gwadar Port in Pakistan and Aden Port in Djibouti, which effectively connect the logistics trade and transport needs of the countries along the Road with those of China.

Third, innovation and cooperation support the development of information infrastructure connectivity. At present, China has 34 land cables and many international submarine cables with countries along the B&R, which directly connect Asia, Africa, Europe and other parts of the world. In cooperation with the International Telecommunication Union, the United Nations Economic and Social Commission for Asia and the Pacific and other international organizations, China has made great efforts to promote connectivity in the information fields such as the East African Information Highway and the Asia-Pacific Information Highway. Chinese information and communication enterprises have participated in the construction of information and communication infrastructure in more than 170 countries around the world. In 2017, Chinese companies built a trans-Himalayan China-Nepal cable in Nepal, providing Nepal's local population with access to the global Internet and cheaper information facilities.

Fourth, power station construction and power grid connectivity continue to promote the development of inter-connectivity in the power sector. From 2013 to 2017, China's power enterprises completed an accumulative investment of USD 8 billion and signed 494 power project contracts with a total value of USD 91.2 billion. China Huaneng Group Co., Ltd. has invested heavily in the China-Pakistan Economic Corridor. The two 660,000-kilowatt coal-fired power plants in Pakistan Sahiwal, constructed by Huaneng are not only listed as "priority projects" of the China-Pakistan Economic Corridor, but also became the first large-scale coal-fired power plants to be put into commercial in the Corridor in 2017. Regarding power grid construction, China operates the world's largest power grid system with the highest voltage level and without large-scale blackouts. China has accumulated vast experience in the investment, construction and operation of large power grids, and has also made important progress in connectivity with the power grids of neighboring countries, which can provide important reference for the construction of transnational power grids in other regions. At present, China has achieved power grid connectivity with Russia, Mongolia, Kyrgyzstan, Vietnam, Laos and Myanmar. By the end of 2016, China State Grid had imported 21 billion kilowatt-hours power from Russia; Southern Grid delivered 33 billion kilowatt-hours of electricity to Vietnam, 1.1 billion kilowatt-hours to Laos, 600 million kilowatt-hours to Myanmar and imported 13.9 billion kilowatt-hours of electricity from Myanmar.

Finally, the construction of the energy pipeline network continued to advance steadily. By June 2018, CNPC had built more than 20,000 kilometers of pipelines for countries along the B&R, making positive contributions to the economic and social development of 47 countries along the B&R. These pipelines delivered more than 200 billion cubic meters of gas to China in 2017. To the northwest of China, the construction of A/B/C/D oil and gas pipeline network in Central Asia has been completed, and the transportation of oil and gas has been realized. In the northern direction, China-Mongolia-Russia and China-Russia natural gas pipeline network construction agreement has been reached, and pipeline network construction continued to advance. In the south, the China-Myanmar crude oil pipeline has been completed, with a daily throughput of 200,000 barrels.

In terms of the Tier III indicators, there is a high degree of polarization. In the area of communications facilities which develops the best, the scores of B21 (Internet penetration), B22 (bilateral communications infrastructure) and B23 (information and communications technology, ICT) service exports are all above 0.6, which is a sign of a relatively balanced development.

However, in the field of transport facilities, the scores of B11 (overall infrastructure quality) and B12 (transport facilities connectivity) are higher than 0.4, which is a sign of good development, but the score of B13 (CHINA RAILWAY Express arrival) is less than 0.2. From this we can see that the internal polarization is serious. In the field of energy facilities, B31 (petroleum transmission capacity), B32 (natural gas transmission capacity) and B33 (electric power transmission capacity) are all very weak and have great development potential in the future. Therefore, in order to further improve the facilities connectivity index between China and countries along the B&R, we should selectively continue to strengthen efforts in the current low-scoring areas, while maintaining and consolidating areas of advantage. At the same time, however, the political and security risks of national projects should be taken fully into account and the development of weak areas should be carefully and steadily promoted.

Based on the above analysis, the research group believes that China's infrastructure cooperation with the Belt and Road countries still needs to be further strengthened in both breadth and depth. The scores of Tier II and Tier III indicators of facilities connectivity show that there are significant polarization differences in the content of specific subareas within the area of facilities connectivity. Specifically, in terms of Tier II indicators, communications facilities are the best developed, well ahead of transport and energy facilities. In Tier III indicators, the development of communication facilities is balanced and good, the field of energy facilities is generally weak, and the development of transport facilities is polarized significantly. Therefore, in order to further improve the facilities connectivity index between our country and the countries along the B&R, while maintaining and consolidating the advantageous projects, we should also focus on the lagging areas in future work planning. At the same time, it should also be recognized that there are objective factors, such as the relative undeveloped transportation and energy facilities, long engineering cycle, difficult engineering and more political and security factors. It is therefore prudent to move forward in areas of weakness, taking fully into account the political and security risks of projects in different nations.

—————————————————————

FOCUS ON CONTEMPORARY NEEDS.

Should you have any questions, please contact us at public@taiheglobal.org