The name, Silk Road (German: Seidenstraße), was first coined in 1877 by the German geographer Ferdinand von Richthofen as a term given to the network of trade routes linking China to Central and West Asia, India and

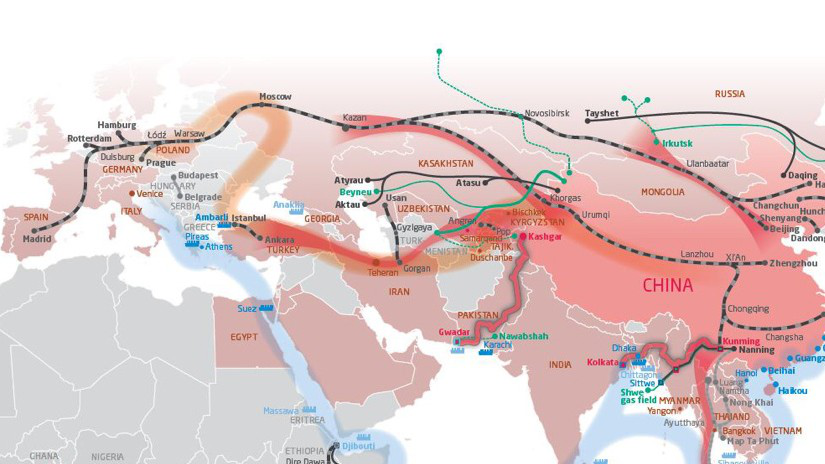

the Mediterranean region. More recently, Peter Frankopan, the director of the Oxford Centre for Byzantine Research, extensively writes about the ancient Silk Road departing from Europe centric views about history. In his research, he highlights that this ancient space of cultural, economic and intellectual exchange did not primarily revolve around China, but many other civilizations connecting the orient with the occident. Today, China is reviving this ancient Silk Road aiming to build stronger relationships with its neighbors through developing and sharing resources. In late 2013, President Xi Jinping announced the New Silk Road or what has become known since then as the Belt and Road Initiative (BRI). The BRI, while still under development, seeks to promote the connectivity of the Asian, European and African regions; establish and strengthen partnerships among the countries along the BRI routes; set up multi-tiered and multimodal connectivity networks; and realize diversified, independent, balanced and sustainable development in the countries involved and promote mutual prosperity among them.

At the World Economic Forum Annual Meeting 2017 in Davos-Klosters, President Xi referred to the ancient Silk Road to emphasize China’s peaceful intention and trade as an inherent human activity that has helped to maintain stability over long periods of time. According to the National Development and Reform Commission (NDRC) of China, the spirit of the ancient Silk Road was passed down

from generation to generation, promoting the progress of civilization and contributing greatly to the prosperity and development of the countries along the Silk Road.

Today, the BRI might have the potential to prompt a profound shift in the global order towards a new multilateralism. The strategic planning and delivery of scalable infrastructure for power generation, transport, water and telecommunications will bring the much-needed economic and societal connectivity to all the countries along this new network. With this proposal, China is willing to share its immense financial and industrial resources and capabilities as well as its own experience of four decades of reform and opening-up, and, at the same time, secure its own long-term development.

The BRI has five major goals within a broad framework of connectivity and collaboration: policy coordination; facilities’ connectivity; unimpeded trade; financial integration; and people-to-people exchange. In a narrower sense, the BRI is primarily a strategic infrastructure initiative of historic proportions. Beyond the initial commitment by the Chinese government of about $1 trillion in infrastructure development, which conservative estimates believe to be viable, the BRI will require roughly an aggregate of $6 trillion for the next 15 years to finance infrastructure projects fueling the 65 national Belt and Road economies. During that period, the Chinese plan to cumulatively invest $4 trillion in total. Some of the investments are already underway, for instance various pipelines such as a 3,666 km gas pipeline between Turkmenistan and China for $7.3B, the economic corridors such as the $46B China-Pakistan highway, railway connections such as a $16.7B Moscow-Kazan high-speed railway and a $2.7B railway from Khorgos on the Chinese border to the Caspian Sea port of Aktau accessing the maritime BRI.

To accomplish these ambitious goals and leverage resources to finance BRI-related projects, a Memorandum of Understanding (MoU) under the BRI was signed between China and several multilateral development banks (MDBs) at this year’s BRI Forum in Beijing in May. They were the Asian Development Bank, the Asian Infrastructure Investment Bank, the European Bank for Reconstruction and Development, the European Investment Bank, the New Development Bank and the World Bank Group.

The MoU covers the following areas:

1.Enhanced support to infrastructure and connectivity projects

2.Building stable, diversified and sustainable development financing mechanisms

3.Improving the business climate

4.Strengthening coordination and capacity-building

5.Supporting the implementation and achievement of the goals set in the United Nations Agenda 2030 for Sustainable Development and the Paris Agreement on climate change

Also, in the MoU China committed to establishing the Multilateral Cooperation Centre for Development Finance to promote concrete actions and cooperation in the above five areas and will invite collaboration with the MDBs.

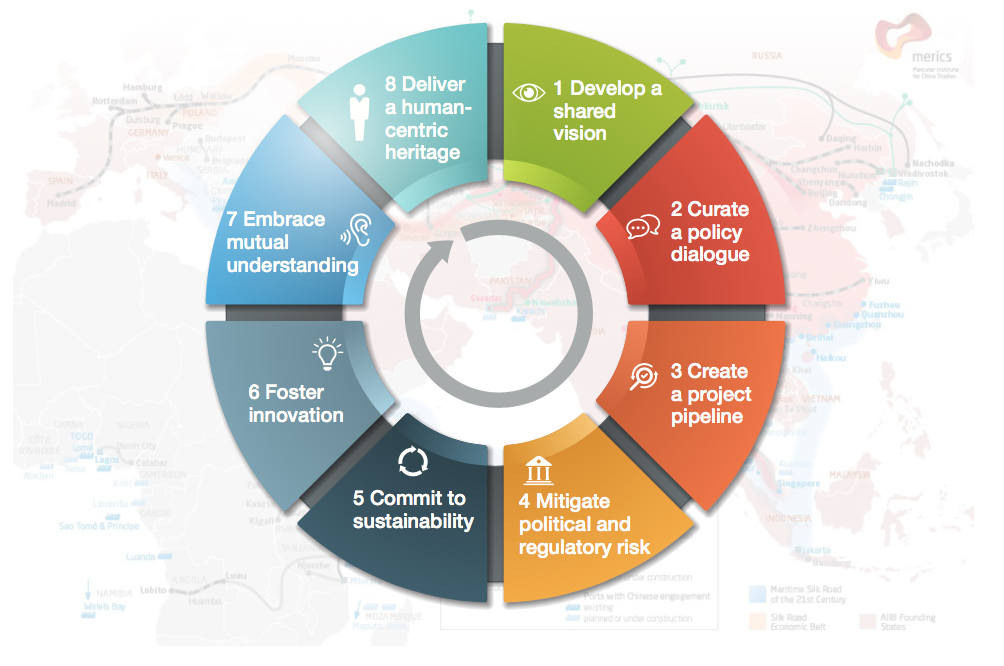

In the light of this initiative and building on BRI’s dimensions of connectivity highlighted above, we anticipate eight transformation factors that have the potential to provide high- level stewardship to the New Silk Road and revive the spirit of shared prosperity.

These insights are derived from several years of analyzing the infrastructure industry and its development projects.

1.Shared Vision: Achieving transnational and international support for a shared vision for strategic infrastructure development that promotes well-being and a national sense of purpose to the communities beyond national borders

2.Multilateralism: Curating an open and multilateral policy dialogue that addresses public-private-civic cooperation, early-stage project financing, standardized procurement, and transparency to level the playing field and build trusted relationships

3.Project-Preparation Facility: Creating an infrastructure project-preparation facility to ensure a pipeline of bankable projects and a transnational centre of excellence to deliver the largest portfolio of projects ever

4.Risk Mitigation: Proactively mitigating political and regulatory risk to boost stakeholder engagement and confidence in the plan by investors, off-takers and operators

5.Sustainable Development: Committing to sustainability, inclusion and affordability principles to generate value for future generations beyond Agenda 2030

6.Innovation: Enhancing technological and business model innovation for sustained value creation, ensuring readiness for the future

7.People-to-People Exchange: Governing domestic and cross-border migration and promoting mutual learning and understanding to enable and deepen people-to- people exchange and transnational cultural cooperation to ensure transcendent growth and universal purpose

8.Human-centric and Future-ready: Delivering the new humane infrastructure heritage beyond the current infrastructure usage for the next millennium

As highlighted elsewhere, the international community not only perceives the BRI as an infrastructure-driven development program but also as a large-scale, soft- power and long-term international policy and security approach. Therefore, the BRI has attracted considerable skepticism. However, today’s increasing lack of global governance has resulted in the absence of international development plans that are comparable to the scope and vision of BRI. To date, the BRI involves 65 countries and accounts for 60% of the world’s population and 33% of global GDP. By lifting 800 million people out of poverty since 1978, China has built up the capacity to provide positive change towards an economically stagnant, geopolitically tense and environmentally degrading planet. No doubt, China’s past 40 years have not been a straightforward transformation process, but the achievements outweigh the sacrifices.

In a narrower sense, the BRI is a large-scale strategic infrastructure development programme, and strategic infrastructure projects have often locked us into unsustainable patterns of development. For this reason, this document seeks to depart from past development deadlocks and shares the insights derived from several years of analysing the infrastructure industry and its development projects. By presenting some of the leading practices, the authors intend to contribute to a holistic and sustainable implementation of the Belt and Road Initiative.

In the following pages, the eight success factors are discussed in more detail. The authors believe that these eight factors of strategic infrastructure and development projects have the potential to successfully drive the New Silk Road and revive a shared spirit of prosperity.

1.Shared Vision: Achieving transnational and international support for a shared vision for strategic infrastructure development that promotes well-being and national sense of purpose to the communities beyond national borders

According to Vision and Actions, the BRI proposes five cooperation priorities: policy coordination; facilities’ connectivity; trade facilitation; financial cooperation; and people-to-people bonds. By policy coordination, the initiative seeks to expand shared interests and establish a cooperation consensus with countries interested in the BRI, which is fundamental for co-developing large-scale

cooperation projects. To realize the BRI’s promise of win-win and shared prosperity, international and systemic leaders have to shift the collective focus from the common reactive problem-solving to inspiring and co-creating the future by developing positive visions for the future.

To accomplish this, it is necessary to emphatically use shared symbols and language to inspire people, articulate aspirations and build confidence based on the growing evidence of accomplishments. To achieve these ambitions, early successes are required. Not only is building an inspiring vision needed but also facing difficult truths and learning how to use the tension between vision and reality to inspire truly new approaches. In the true spirit of multistakeholder engagement, the people have to collectively address and answer the “why”, “how” and “what” of a shared long-term vision.

This vision is needed to imagine and build inclusively global future communities that are embedded in a desirable, and supporting, built environment. A key responsibility is to provide essential infrastructure and urban solutions that meet the basic human needs that support well-being, the movement of people and ideas, as well as deliver critical services, assets and goods. These needs can and should be elevated and expanded by giving serious consideration to quality of life and community happiness. Thus, the core purpose of the BRI will be to provide indispensable value for society, including safe living, clean air, clean water and sanitation, as well as physical and social interconnectedness.

A good example of a best-in-class shared vision is provided by the Programme for Infrastructure Development in Africa (PIDA), formulated by the African Union Commission, in partnership with the United Nations Economic Commission for Africa, the African Development Bank and the NEPAD Planning and Coordinating Agency. Given Africa’s urgent infrastructure needs, the project and programme list for short- and medium-term implementation of the Priority Action Plan (PAP) lies at the heart of PIDA. Although the entire programme can be considered the pipeline for Africa’s long-term regional infrastructure development, the PAP details the immediate way forward by presenting actionable projects and programmes that promote sound regional integration between 2012 and 2020. Projects and programmes under the PAP represent the first batch of agreed priorities resulting from the analysis, criteria review and consultations on the master plans of the Regional Economic Communities (RECs). It represents the priority pipeline required to meet the PIDA outcomes. This reflects the need to ensure coherence with RECs’ master plans and consistency with the PIDA strategic framework over the next three decades.

2.Multilateralism: Curating an open and multilateral policy dialogue that addresses public-private-civic cooperation, early-stage project financing, standardized procurement, and transparency to level the playing field and build trusted relationships

To ensure the formation of long-term and trusted relationships, an open and multistakeholder dialogue needs to be established. The willingness of the private sector to support and finance major investment projects in any country will be heavily influenced by perceptions of the country’s national, regional and local development policies coupled with public-private-civic cooperation

policies. Curating an open and transparent multilateral policy dialogue, and establishing a clear policy framework within and between the Belt and Road countries, helps both the public and private sectors to understand the core rationale for aligning synergies on sustainable development.

Public-private cooperation is difficult to achieve in an unstable policy environment. Effective and concise policies explain and broadcast the objectives and roles each partner needs to adopt, and provide the details of the public-private programmes and the advantages and limitations of the cooperation approach.

The authors of this text recommend greater public-private- civic cooperation to drive transformation across all aspects of the infrastructure development value chain, which includes policy-making, governance design, planning, engineering and design, financing, implementation, operation and maintenance and monitoring of infrastructure and urban development projects.

The World Economic Forum recently conducted a global survey to identify the level of preparedness of key city stakeholders. The results indicated that the private sector is often better placed to support urban transformation agendas and is already necessary for all aspects of the urban value chain, which includes policy-making, planning, design, implementation, operation and maintenance and monitoring, as well as financing urban development projects. The report showcases concrete examples, from the pooled bond for funding urban infrastructure projects in India, working within affordability constraints of the N4/N6 Kinnegad-Kilcock motorway in Ireland, the service output-based payment mechanism of an urban transport project in Mexico, to examples in Australia of a comprehensive analysis leading to project time- and cost-savings in Sydney and life-cycle cost risk and allocation for the Spencer Street Station redevelopment in Melbourne.

3.Project-Preparation Facility: Creating an infrastructure project-preparation facility to ensure a pipeline of bankable projects and a transnational centre of excellence to deliver the largest portfolio of projects ever

Infrastructure development is widely recognized as a critical enabler of economic activity within and across

national borders. Well-planned and structured infrastructure projects are a prerequisite for regional integration. However, preparing infrastructure programmes to attract private investment, which is undoubtedly needed to finance the BRI infrastructure gap, can be complex and demanding.

A recent World Economic Forum report proposes a so-called principled approach to infrastructure project- preparation facilities (IPPF), ensuring a pipeline of bankable infrastructure projects is significantly enhanced through

a better designed and resourced project or programme- preparation phase. A better-prepared project pipeline will produce benefits for many stakeholders: better value for users; reduced project risks for investors; and increased opportunities for private-sector businesses via contracts for constructing or operating the new assets, or both.

Above all, the overall boost to the region’s infrastructure will also mean a social and economic boost, which will benefit all the region’s inhabitants. The Forum report assessed leading practices globally and came up with five key principles of success, including clear objectives and a focused strategy, a self-sustainable financing model, excellence in portfolio management, cost-efficient and value-adding advisory services, as well as stringent governance and accountability.

A good example of an IPPF is provided by the Brazilian Development Bank (BNDES). The bank’s mission is to foster sustainable and competitive development in the Brazilian economy, particularly by generating employment while reducing social and regional inequalities. In line with its mission, BNDES created a project development division (AEP), which aims to provide better-prepared projects to

the market via its subdivisions. By means of a project- structuring fund, BNDES creates an enabling environment for particular sectors and strategically identifies infrastructure projects. Furthermore, a project structuring company (EBP) concentrates on developing and structuring public- private partnerships (PPPs) or concessions – on behalf of government agencies – for infrastructure projects such as airports, motorways, ports, public transport, sewage and social facilities.

Another example is the New Development Bank’s special funds dedicated to support project preparation, as foreseen in the NDB’s general strategy for 2017-2021.

4.Risk Mitigation: Proactively mitigating political and regulatory risk to boost stakeholder engagement and confidence in the plan by investors, off- takers and operators

More than $1 trillion annually is needed to bridge the infrastructure gap globally. During the different stages of their lifecycles, infrastructure projects are exposed to various types of political and regulatory risk: during the planning and construction phase, delayed construction permits and community opposition; during the operating phase, changes to various asset-specific regulations and outright expropriation; and towards the end of a contract, the non-renewal of licences and tightened decommissioning requirements. In addition, some broader risks apply throughout the lifecycle and can affect an entire infrastructure sector, such as changes to sector regulation or taxation laws and endemic corruption.

To address political and regulatory risks, a recent World Economic Forum report presents a risk-mitigation framework, listing 20 measures that can be taken by the public sector, the private sector and jointly by the different stakeholders. The report examines various elements of political and regulatory risk in infrastructure projects and identifies factors that need to be harnessed so investment can flow more efficiently and in greater volume. The proposed framework enables policy-makers and companies to take a holistic view of the potential levers, adopt international leading practices and hence undertake a comprehensive effort to mitigate political and regulatory risk.

The report showcases numerous examples of political and regulatory risks in many areas across many jurisdictions. From risks during the project planning/design/construction phase, such as the cancellation and change of scope risk at the 165km Lisbon-Madrid high-speed rail in 2009, to risks during the project operations phase to risks during the project closeout phase.

5.Sustainable Development: Committing to sustainability, inclusion and affordability principles to generate value for future generations beyond Agenda 2030

In order to build the New Silk Road for the next generations, a strong commitment to sustainability, affordability and inclusion is required. The Infrastructure and Urban Development industry and its large infrastructure programmes not only underpin the global economy – providing crucial infrastructure facilities, commercial buildings and industrial plants to drive economic activity and growth – but also have a powerful influence on the environment and society.

This sector is central to the footprint of human activity. It is the largest consumer of raw materials worldwide. More than 30% of greenhouse gas (GHG) emissions are attributed to infrastructure and urban assets, and 50% of solid waste is produced by the construction industry. Equally, it is central to the goal of creating an environmentally sustainable future. Leaders have to recognize the imperative to avoid dangerous climate change by limiting the global average temperature rise to less than 2°C, and understand that the existing trend of the world’s net GHG emissions is not consistent with this goal.

By acknowledging that the infrastructure industry is responsible for a significant amount of the world’s carbon emissions and for other environmental impacts – including waste production, pollution, use of water and consumption of other natural resources – this sector has a fundamental responsibility to help meet sustainability targets through global agreements such as the Paris Agreement on climate change (COP21), the United Nations’ Sustainable Development Goals (SDGs) and Habitat III. As highlighted elsewhere, the BRI has the potential to become a platform for implementing the 17 SDGs. All BRI partner countries have committed to these goals. China and another 146 countries have also ratified the Paris Agreement. Infrastructure is one of the least innovative industries, but with today’s technologies it could already save significant amounts of carbon emissions.

The Forum’s Future of Construction Working Group on Affordability has shed some light on how to create high- quality, affordable infrastructure and housing. In a series of essays, the group highlighted the need to adopt a holistic view of affordable housing, taking into account economic, social, environmental and cultural sustainability. A Working Group on Sustainability showcased solutions on how to achieve carbon-neutral assets and reduce waste during construction. However, sustainable infrastructure has to be financially viable to contractors and operators. This will be feasible only if we consider reduced life-cycle costs, long-term benefits and society’s demands. For commercial buildings, the market has matured, with sustainable buildings in demand, with higher rents, higher resale value and lower operating costs.

6.Innovation: Enhancing technological and business model innovations for sustained value creation, ensuring readiness for the future

Relative to other industries, productivity in construction has stalled over the past 50 years. Technology was not making fundamental advances and companies remained averse to changing their traditional methods. Recently, however, transformative technological developments have emerged and have been adopted by pioneering firms for current projects. These developments – such as 3D printing, building information modelling, wireless sensing and autonomous equipment, and new building materials – are starting to turn traditional business models upside down.

The most recent reports of the Future of Construction initiative suggest how a transformation of the sector is possible to unleash its full potential. Given the sheer size of the industry, even small improvements would provide substantial benefits for society. To capture such potential, an industry transformation framework was introduced listing 30 measures, supported by many best practices and case studies of innovative approaches. Some of the measures can be adopted by private companies on their own, while others require collaboration with their peers or with other companies along the construction value chain. In addition, some of the measures can be adopted by government, acting both as the regulator and as the major owner of infrastructure projects.

At the World Economic Forum Annual Meeting 2017, the initiative presented strong examples of successful innovation adoption in the 10 so-called lighthouse innovation cases, such as The Edge – the world’s most sustainable office building; the New Karolinska Hospital – the largest hospital ever delivered through a PPP delivery model for a leading healthcare institution; Anglian Water’s @One Alliance – a leading industry alliance in the water sector; Moladi – one of the world’s most scalable, affordable and socially accepted housing systems; and Burj Khalifa – the world’s tallest building.

Furthermore, examples of successful innovation adoption were provided by start-ups and pilot projects, such as the Broad Sustainable Building – the record holder for the fastest construction of an over 50-storey skyscraper; MX3D – the creator of the world’s first 3D-printed steel bridge; ADITAZZ – a disruptive, automating building design technology; WINSUN – a pioneer of 3D-printed houses at scale; and UPTAKE – a predictive analytics company, which was one of Forbes’ Hottest Startups of 2015.

7.People-to-People Exchange: Governing domestic and cross-border migration and promoting mutual learning and understanding to enable and deepen people-to-people exchange and transnational cultural cooperation to ensure transcendental growth and universal purpose

The ancient Silk Road, as Peter Frankopan highlights, was not a single corridor from China to the West, but a vast network of land and maritime routes connecting Asia with Europe and parts of Africa. Agrarian dynasties, states, tribes and cities had strong interests in those trade routes. They contributed not only to economic prosperity but also to culture and people exchange within and between the Silk Road countries. China did not act as a trading hub, or as the cultural and economic centre of the ancient Silk Road, but was one country among many trading countries.

Although the ancient Silk Road was plagued by upheaval and tension, most of the time the countries along the trade routes coexisted peacefully. In addition to territorial and trade agreements, migration and the cross-pollination of cultures led to long periods of stability.

In response to rising anti-globalization sentiment and geopolitical tension globally, President Xi frequently refers to the ancient Silk Road to highlight the fact that trade is a natural human activity beneficial to society. Economic and cultural exchanges are two sides of the same coin. The former must be balanced and create win-win relations; the latter helps to strengthen human bonds by establishing mutual understanding and shared meaning.

These days, we tend to analyse, compare and cluster countries from the perspective of mere performance indicators and approach them as abstract markets and infrastructure. In contrast, the new Silk Road already stretches along countries that make up regions with a shared history and long-term historical connections. Those historical bonds need to be revitalized.

New infrastructure, new trade routes, migration and newly emerging markets can disrupt existing, traditional patterns of relationships and meaning. Only the issue of rural-to- urban and cross-border migration can cause a tremendous challenge towards the BRI and its countries. In total, there are 242 million international migrants, of which 82 million belong within the South-South migration movement. The migration pattern of the BRI region falls into this latter category. Along the route, there are 4.5 billion people, potentially a huge labour-force reserve. Since reforms in China, about 200 million people have migrated from the countryside to the cities. The government has handled such an unprecedented migration relatively well. However, China does not have much experience dealing with the issues related to cross-border migration. In such a transformation, focusing on people-to-people bonds, governing migration and promoting educational and cultural exchanges will be crucial for the success of the BRI.

“I see the Belt and Road Initiative as a soft-power infrastructure – to provide younger generations with the knowledge, values and openness of mind to shape more inclusive and peaceful societies, to master the language of diversity, to navigate across cultures,” said the UNESCO Director-General, Irina Bokova, at the Belt and Road Forum for International Cooperation in Beijing on 14 May 2017. She added: “Over millennia, the wondrous story of the Silk Roads has been one of encounters – between people, cultures, religions and knowledge. These encounters have shaped civilizations over the ages, catalysing inventions, fertilizing intellectual scholarships. The Silk Roads tell a story of human progress driven by mutual learning and remind us that no culture has ever flourished in isolation.”

8.Human-centric and Future- ready: Delivering the new humane infrastructure heritage beyond the current infrastructure usage for the next millennium

What should infrastructure assets look like in 100 years? To make sure our infrastructure is future-ready and will build a legacy beyond the current infrastructure definition, the necessary flexibility needs to be built into today’s designs. The DNA of today’s infrastructure needs to include repurposing and upgrading capabilities since we don’t know the infrastructure requirements of the future – even more so in the wake of the Fourth Industrial Revolution.

What we do know, however, is that it is preferable the human being should still be in control and at the centre of the urban and infrastructure design. Therefore, we have to make sure to place people and their living standards at the centre of economic and technology policy. To effectively respond to the wealth-concentrating technological disruption caused

by the Fourth Industrial Revolution, an alternative, human- centred economic growth model is needed. This new growth model requires that social inclusion is consciously designed into an economic “human-centric” policy in a concerted effort. The net increase in prosperity and opportunity enabled through technology and globalization has to be the basis for broadening, strengthening and redistributing wealth more widely among workers, families and communities.

The internet of things (IoT) is a vast number of internet- connected objects and devices that have already exceeded the number of humans on Earth. Nowadays, there is a novel IoT paradigm that is rapidly gaining ground: a scenario of human-centric smart environments in which people are not passively affected by technology but actively shape its use and influence. The Fourth Industrial Revolution will require governments to move beyond reactive measures aimed at efficiency and short-term growth. They will need to proactively chart a course that mitigates the social risks of new technologies and strengthens the positive feedback between growth and inclusion in an economy through a stronger emphasis on certain key domestic institutions.

As President Xi said in Davos: “We should develop a new development philosophy and rise above the debate about whether there should be more fiscal stimulus or more monetary easing. We should develop new growth models and seize opportunities presented by the new round of industrial revolution and digital economy. We should strike a balance between efficiency and equity to ensure that different countries, different social strata and different groups of people all share in the benefits of economic globalization. The people of all countries expect nothing less from us and this is our responsibility as leaders of our times.”

Thorsten Jelinek, Director, Taihe Institute

Olivier Schwab, Head of Business Engagement and Member of the Managing Board, World Economic Forum

Michael Max Buehler, Head of Infrastructure and Urban Development, World Economic Forum

Sergio Suchodolski, Director General, Strategy & Partnerships, New Development Bank1

Pedro Rodrigues De Almeida, Member, B20 Task Force on Financing Growth & Infrastructure

The original version of this paper was first published on the website of the World Economic Forum:

http://www3.weforum.org/docs/WEF_Eight_Success_Factors_New_Silk_Road_2P_2017.pdf

—————————————————————

FOCUS ON CONTEMPORARY NEEDS.

Should you have any questions, please contact us at public@taiheglobal.org